BOC Data Warehouse

Project Overview

The BOC Data Warehouse Web Service is a sophisticated financial management and recovery assessment platform built for large-scale banking operations. It streamlines the evaluation of customer creditworthiness by automating multi-year financial statement analysis, ratio calculations, and recovery cashflow projections. Replacing manual spreadsheet workflows, this system ensures data integrity, speed, and accuracy in high-stakes financial decision-making.

Key Features

- Dynamic Multi-Year Analysis: Real-time management of historical (Audited) and projected financial data.

- Automated Ratio Engine: Instant calculation of KPIs like Sales Growth, PAT/Sales, and Liquidity Ratios.

- Recovery Cashflow Modeling: Specialized modules for Contractual, Restructured, and Rescheduled schedules.

- Collateral Valuation Intelligence: Automated property value adjustments based on geography and depreciation.

- Bulk CSV Integration: Intelligent data onboarding with automatic template generation and mapping.

- Banking Security & PF Validation: Integrated employee authentication using PF numbers for secure access.

Core Innovations

Dynamic Metric Engine

Developed a high-performance calculation engine that updates complex financial ratios instantly as users modify entries, providing immediate feedback for credit risk assessment.

Automated Recovery Projections

Implemented specialized algorithms for Present Value (PV) calculations and recovery cashflows, reducing manual accounting tasks by over 80% while eliminating human error.

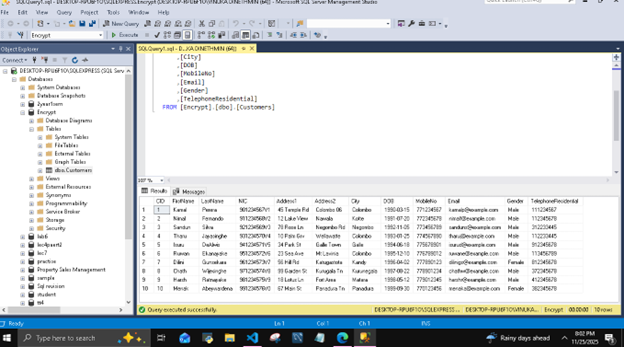

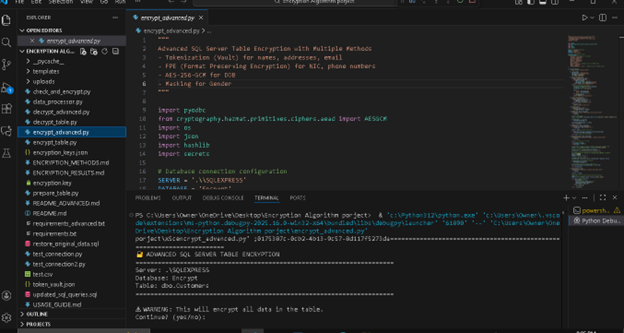

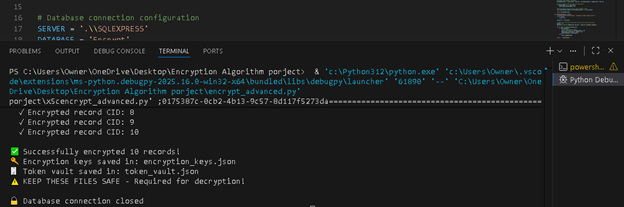

Technologies Used

System Interface Preview

Impact

By digitizing the credit assessment workflow, this web service has empowered financial analysts to handle complex data sets with unprecedented speed. The system's ability to automatically sort years chronologically, calculate turnover days, and project future cashflows has transformed the department's efficiency, turning a once labor-intensive manual process into a streamlined, enterprise-level digital experience.