SLIPS Generator Pro

Project Overview

SLIPS Generator Pro is a specialized enterprise automation utility developed to streamline the Sri Lanka Interbank Payment System (SLIPS) workflow. Built for High-Volume banking operations at BOC, it automates the transformation of raw Excel transactional data into bank-compliant, fixed-width text formats. By implementing intelligent column detection and real-time validation, the system eliminates human error and reduces file preparation time from hours to seconds.

Key Features

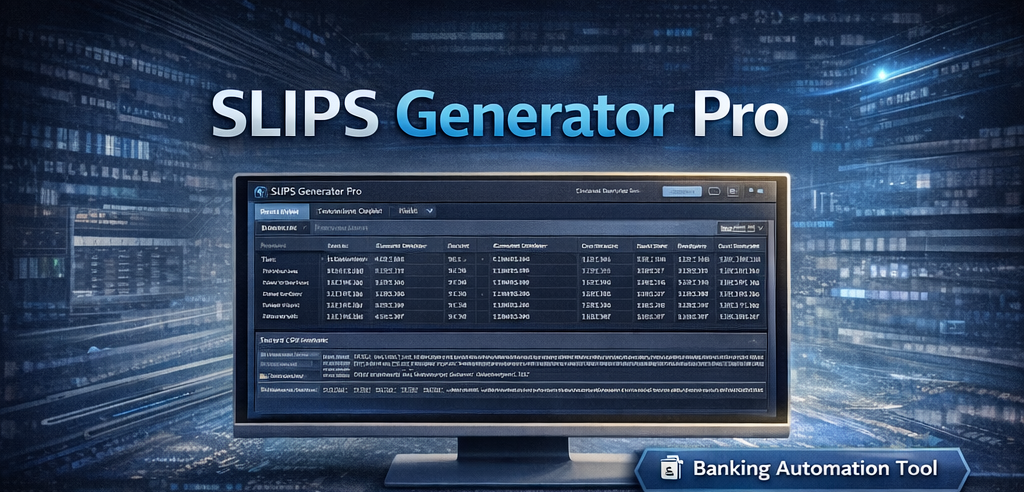

- Intelligent Keyword Mapping: Automatically detects and maps Excel columns for Branch Code, Account Numbers, and Balances using fuzzy logic.

- Originating Account Auto-Fill: Smart extraction of sender details from the first data row to minimize manual input.

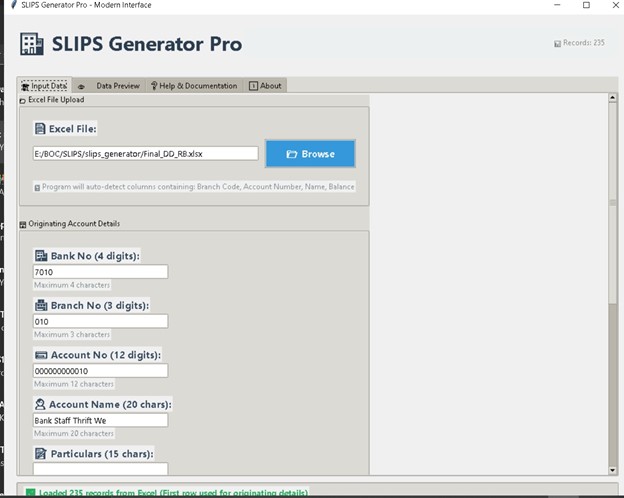

- Standardized Fixed-Width Output: Generates precise 150-character records following strict SLIPS transaction protocols.

- Modern Tabbed Interface: A professional GUI featuring dedicated tabs for Data Input, Real-time Preview, and Help Documentation.

- Real-time Data Validation: Integrated checks for character limits, numeric formatting, and mandatory field requirements.

- Dynamic Value Dating: Calendar-integrated date selection system formatted specifically for banking back-end systems (YYMMDD).

Core Innovations

Flexible Mapping Engine

Developed a robust parsing engine that allows users to upload Excel files with varied layouts, automatically identifying relevant headers and reducing the need for strict template adherence.

Automated Transaction Numbering

Implemented a sequential record generation system that handles batch headers and individual transaction lines with automated zero-padding and compliant alignement.

Technologies Used

System Interface Preview

Intelligent Data Input & Configuration

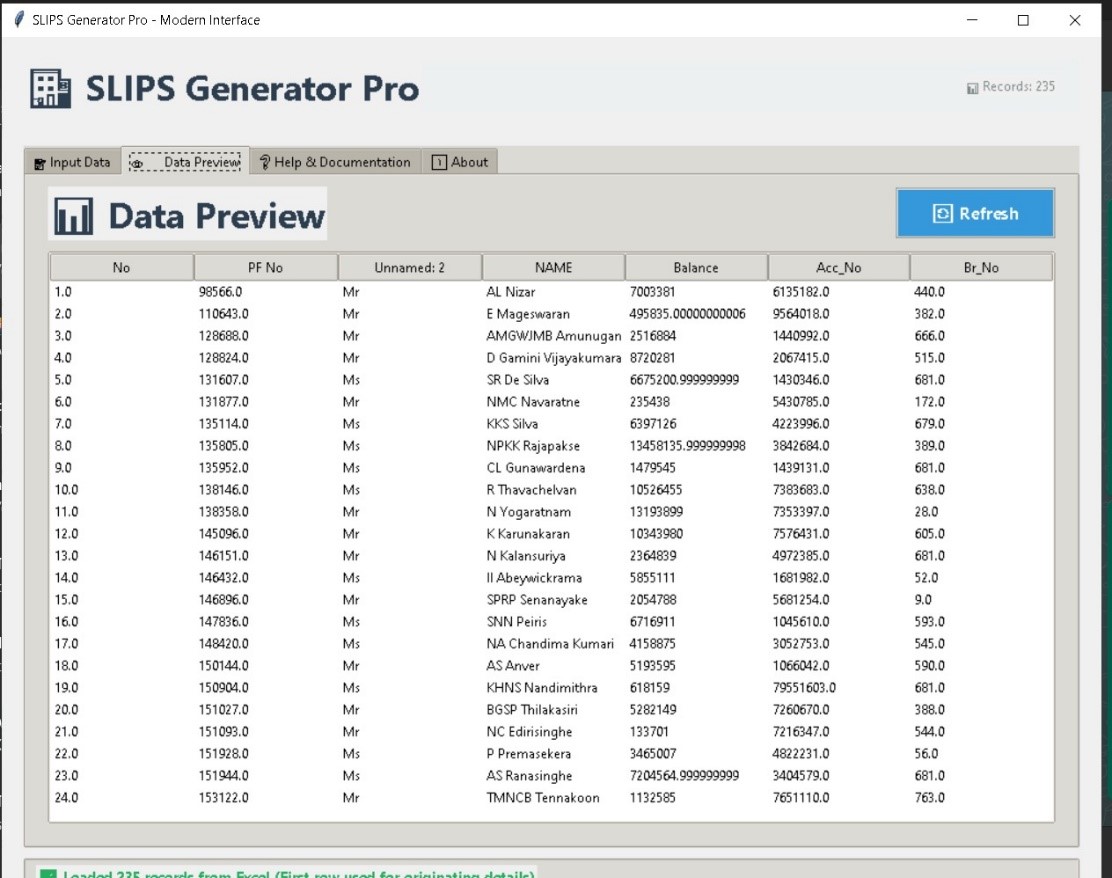

Integrated Data Verification Table

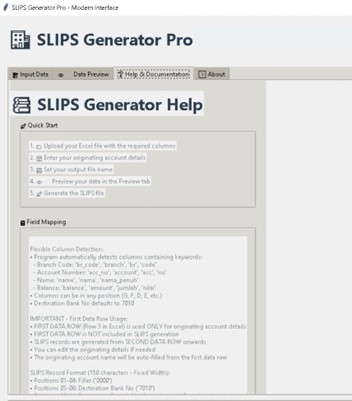

In-App Banking Standards Guide

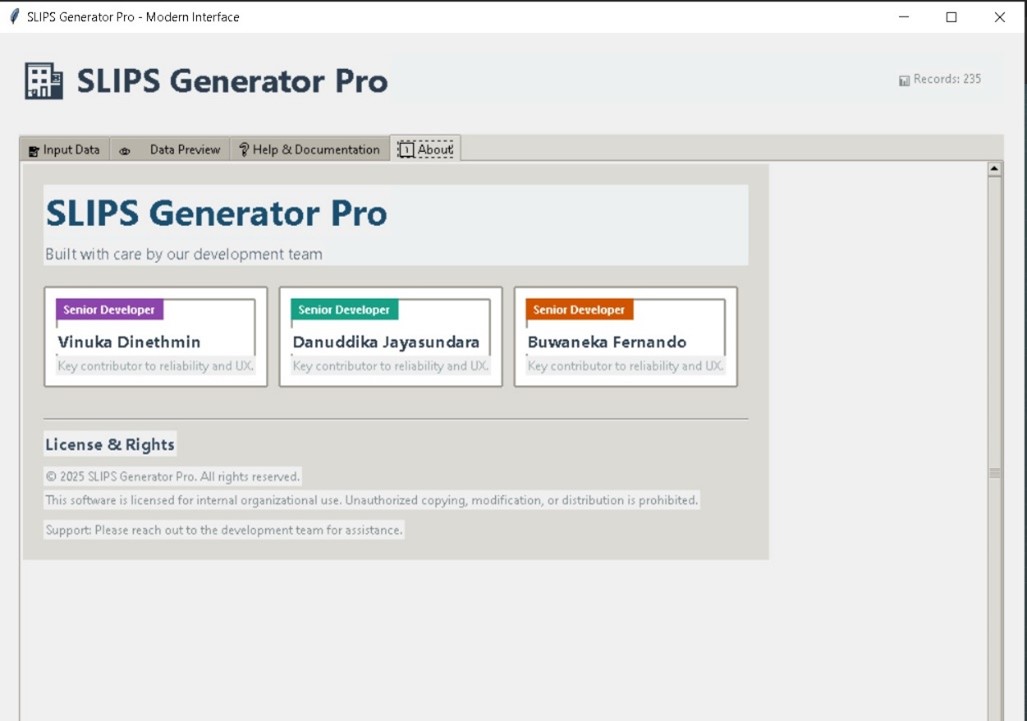

Developer & Version Control Overview

Core System Parameters

Compliant SLIPS File Generation

Impact

By digitizing the manual SLIPS file creation process, this tool has significantly enhanced operational reliability. It ensures 100% compliance with banking fixed-width standards, effectively preventing transaction returns caused by formatting errors. The automation of the originating detail extraction has further simplified the user journey, making it an indispensable asset for financial analysts managing large-scale bulk payments.